Art Laffer: Every problem has a government solution to Kamala Harris

Former Reagan economist Art Laffer reacts to the vice president pushing for trillions in handouts on Kudlow.

Vice President Harris’ economic policy roll out continued Monday as her campaign said that if she wins the presidency she would push to raise the corporate tax rate to 28% from its current level of 21%.

Harris campaign spokesperson James Singer said the policy is “a fiscally responsible way to put money back in the pockets of working people and ensure billionaires and big corporations pay their fair share.”

The U.S. corporate tax rate was 35% when former President Trump, who is now Harris’ main electoral rival for the presidency, and congressional Republicans enacted the Tax Cuts and Jobs Act (TCJA) in 2017. The law lowered the corporate tax rate to 21% while also reducing personal income taxes for most taxpayers.

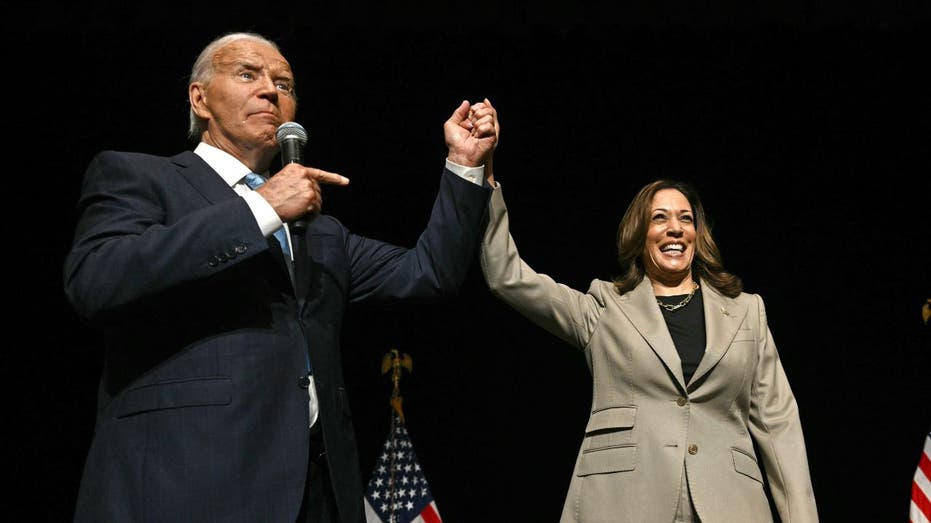

Harris’ proposal aligns with President Biden’s budget proposal for fiscal year 2025 that was released earlier this year and had the corporate tax rate rising to 28%.

HARRIS’ ECONOMIC PLAN WOULD ADD OVER $1.7T TO NATIONAL DEBT: CRFB

Vice President Harris’ campaign said that she supports raising the corporate tax rate from 21% to 28%. (Allison Joyce/AFP via Getty Images / Getty Images)

It also represents a departure from the position Harris adopted in her short-lived 2020 presidential campaign, in which she called for returning the corporate tax rate to its pre-TCJA rate of 35% to help finance her progressive platform.

An analysis by the nonpartisan Tax Foundation of the FY2025 Biden-Harris budget proposal found that the higher corporate income tax rate had the most significant negative impact on economic growth and the labor market of the policies put forward.

HARRIS SAYS HER ECONOMIC PLAN WILL ‘PAY FOR ITSELF’

Vice President Harris’ stance on raising the corporate income tax rate to 28% aligns with President Biden’s budget. (Brendan Smialowski/AFP via Getty Images / Getty Images)

“Raising the corporate income tax rate to 28 percent is the largest driver of the negative effects, reducing long-run GDP by 0.6 percent, the capital stock by 1.1 percent, wages by 0.5 percent, and full-time equivalent jobs by 128,000,” the Tax Foundation wrote.

The organization’s analysis estimated that raising the corporate tax rate to 28% would bring in $1.023 trillion in tax revenue over the 2024-2034 period.

U.S. ECONOMISTS LIST TOP ELECTION ISSUES: NABE

The Biden-Harris administration was unable to raise the corporate tax rate when Democrats controlled both chambers of Congress. (Allison Joyce/AFP via Getty Images / Getty Images)

The nonpartisan Committee for a Responsible Federal Budget (CRFB) also analyzed the FY2025 Biden-Harris budget proposal, which found that raising the corporate income tax rate from 21% to 28% would bring in $1.425 trillion in tax revenue over 2024-2034.

Raising the corporate income tax rate to 28% would push that rate above the worldwide average, which stood at an average of 23.45% on average across 181 jurisdictions as of December 2023, according to the Tax Foundation. When weighted by GDP, it found the average corporate tax rate was 25.67%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Harris’ announcement comes after she unveiled part of her economic agenda on Friday that CRFB estimated would cost at least $1.7 trillion over a decade, potentially rising to $2 trillion if certain provisions supporting the housing industry were made permanent.

Reuters contributed to this report.